Couple handed $3500 bill from mortgage adviser after selling first home

A young couple who were handed a $3500 bill by their mortgage adviser soon after the birth of their first child complained they were blindsided by the bill.

The pair took their complaint to Financial Services Complaints, a scheme that deals with complaints about financial service providers that cannot be resolved directly. It does not identify the parties involved.

In this case, the couple bought their first home in 2020, with help from a mortgage broker. But this year, they found they were expecting a baby and needed to move to a bigger place.

A different mortgage adviser helped them get the finance in place.

But soon after they moved, their first broker called to say that because the loan on their first home had been repaid early, he was going to charge them a fee. The couple assumed that he meant the early repayment fee they had paid to break their loan with the bank.

But then they received an invoice for $3500.

Their baby had been born six weeks early and the woman was on parental leave earlier than expected, which reduced their income. They contacted the broker to say they did not know that this fee would be charged and had not budgeted for it. They said they could not afford to pay.

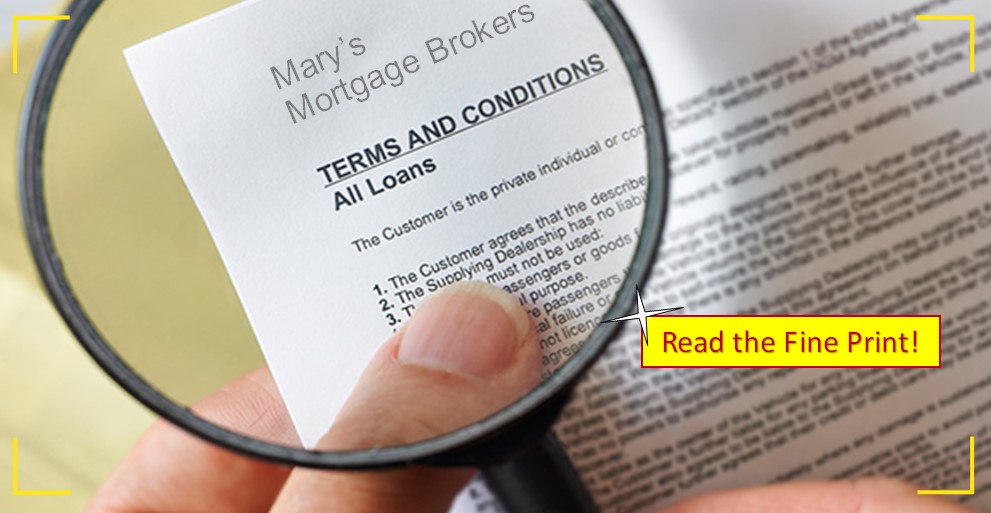

The mortgage adviser responded with a copy of his terms off engagement, which stated that if a loan was repaid either in full or partially within 27 months, the bank would claw back the brokerage fee paid to the broker.

That amount would then be sought from the client if they had not given the broker the chance to arrange alternative finance for them.

The couple took their complaint to FSCL, saying they had budgeted for a payment to the bank for breaking their term but no one had pointed out they would also have to pay the mortgage adviser.

“To be sprung with such an unexpected and extravagant fee is unjust and unfair and it is clearly something we cannot afford to pay as we are down to one income now due to my wife being on maternity leave,” the man said.

“Such a substantial fee should be explained to customers first and foremost when we request your services. It appears to be a hidden fee.”

The mortgage adviser offered to reduce the fee by half, which the couple did not accept.

When FSCL started to look into it, the broker said he would waive it entirely.

FSCL said a mortgage adviser’s services were usually free because they were being paid by the bank.

“If the borrower repays the loan early the bank will recover, or ‘clawback’, some of the money the bank paid to the mortgage adviser, effectively depriving the mortgage adviser of some of their income. The mortgage adviser will then invoice the borrower to recover the money that they have lost. Although the clawback fee is likely to be mentioned in the mortgage adviser’s contract with the borrower, many borrowers are completely unaware that the mortgage adviser might charge them a fee if the loan is repaid early and are shocked at the amount of the fee, often a few thousand dollars.”

FSCL said there was a 15% increase in the number of complaints it received in the 2022 financial year, up 15% compared to a year earlier, to 1077.

Of the 214 cases formally investigated, the largest proportion of complaints were about consumer credit products at 29%, followed by mortgage loans at 10% and credit cards at 9%.

“The increase in complaints is reflective of the challenges in the wider economic environment,” said chief executive Susan Taylor.

She said history had shown with the global financial crisis in 2008, an economic downturn inevitably means an increase in complaints.

“At times of economic turbulence with consumers facing increasing pressures and rising costs, maintaining consumer confidence in the financial markets is more important than ever.”

Continue reading from Stuff HERE