When you own a property in Wellington, you eventually face a big question: do you keep it as a rental or is it time to sell? This choice really boils down to one crucial trade-off: long-term wealth building versus immediate financial freedom and simplicity.

Renting can be a great way to generate ongoing income and build wealth through capital growth, particularly in sought-after suburbs like Karori or Khandallah. On the other hand, selling unlocks your equity right now, giving you cash for new opportunities without the hands-on demands of being a landlord.

The Wellington Landlord or Sell Dilemma

Deciding whether to sell or hold onto your Wellington property is easily one of the biggest financial choices you’ll make. It’s a classic balancing act between the promise of a steady rental income and the appeal of a lump sum profit and a simpler life.

This decision isn’t just about the numbers on a spreadsheet. It’s about your personal goals, your comfort level with risk, and what you want your future to look like. As a local real estate professional, I have helped many Wellington homeowners navigate this exact crossroads with confidence.

For many, the idea of being a landlord is appealing. It brings to mind a passive income stream and the solid security of a tangible asset. The reality, though, especially in a unique market like Wellington’s, involves a lot more active management and navigating a complex web of responsibilities.

Comparing Your Two Paths

The choice is rarely black and white. What works for an owner with a flat in student heavy Aro Valley is probably not the right move for someone with a family home in Karori. To help you think it through, let’s break down the core differences between renting out your property and selling it.

| Consideration | Keeping as a Rental | Selling the Property |

|---|---|---|

| Primary Benefit | Potential for long-term capital growth and consistent monthly income. | Immediate access to your property’s equity and financial liquidity. |

| Main Challenge | Ongoing responsibilities: tenant management, maintenance, and legal compliance. | Timing the market correctly and covering the upfront costs of selling. |

| Financial Outlook | Gradual wealth accumulation, offset by expenses like rates and repairs. | A significant one-off financial gain, ideal for reinvesting or other life goals. |

| Lifestyle Impact | Requires time and energy for management, even with a property manager. | A clean break, freeing you from landlord duties and property-related stress. |

This guide will walk you through the financial, practical, and market-specific factors you need to weigh up. With insights into the Wellington market, you’ll gain the clarity needed to make a confident choice that feels right for you and your circumstances.

Analyzing the Financial Case for Renting vs Selling

Making a smart property decision always starts with a clear financial picture. If you’re weighing up whether to keep your Wellington property as a rental, you need to crunch the numbers and lay out the potential outcomes of renting versus selling, side-by-side.

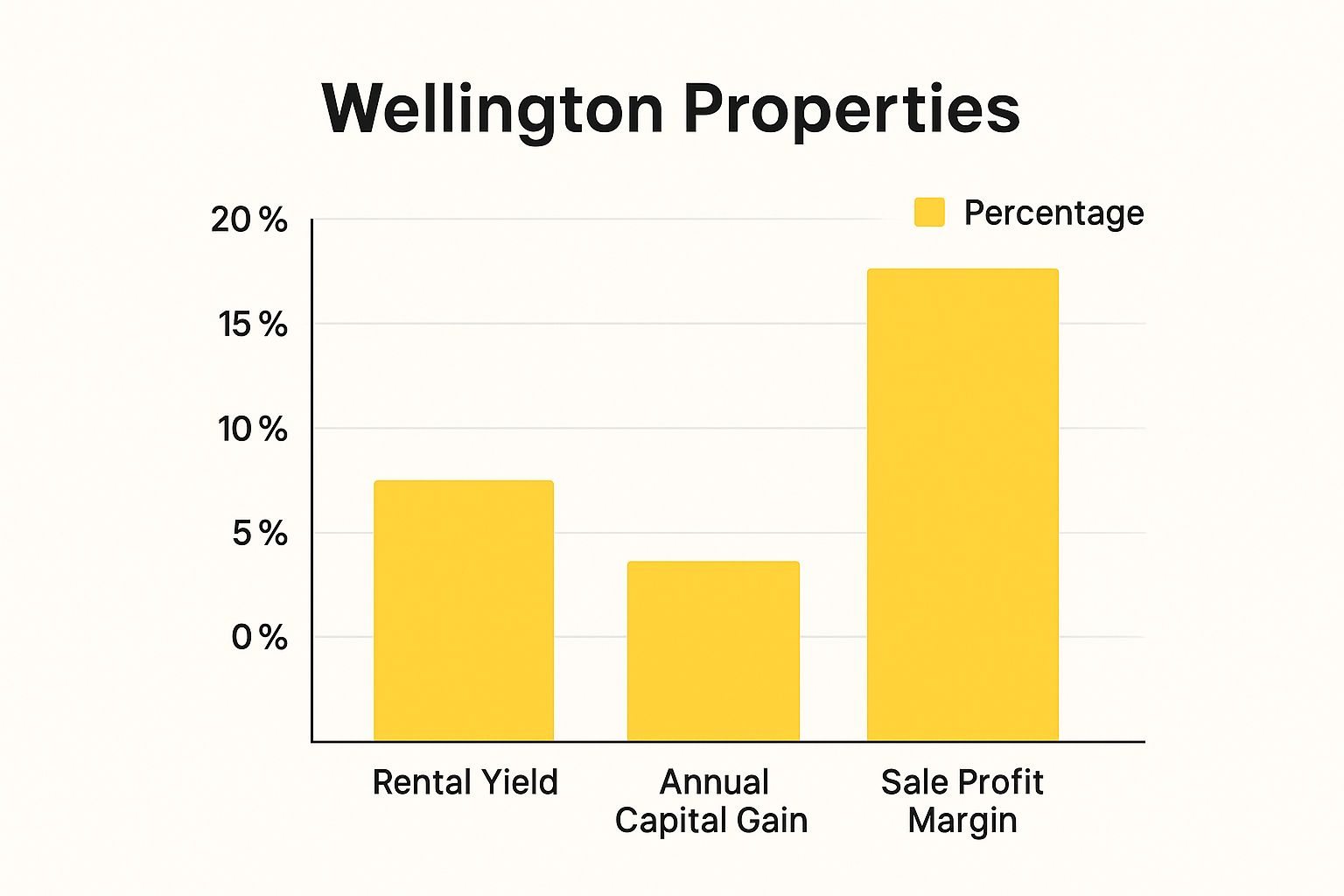

This infographic gives a quick comparison of the key financial metrics for a Wellington property, including rental yield, capital gain, and sale profit margin.

As the data shows, rental yields and capital gains can offer steady, slower returns over time. On the other hand, the potential profit from a sale can be a lot more substantial in the short term.

The Financials of Renting Your Property

Holding onto your property and renting it out is definitely playing the long game. Your returns will come from two main sources: the weekly rental income (your yield) and the gradual increase in your property’s value over the years (capital gains).

A typical three-bedroom home in a suburb like Ngaio or Brooklyn might bring in a steady income, but you’ve got to weigh that against the ongoing costs. Think council rates, insurance, property management fees (which are usually around 8-10% of the rent), and having a fund set aside for maintenance and unexpected repairs. You can dive deeper into this topic in our guide on calculating rental returns.

A massive factor for landlords right now is the change in tax laws. The government’s decision to reintroduce 100% mortgage interest deductibility, which kicked in on April 1, 2025, is a significant incentive. It means landlords can deduct their mortgage interest from their taxable income again, which directly improves cash flow.

However, it’s worth noting this benefit is arriving against a backdrop of pretty flat rental growth in Wellington, sitting at around 1% annually, largely because of an increasing housing supply and economic conditions.

The Financials of Selling Your Property

Selling your property delivers a completely different financial outcome, one focused on immediate cash. The biggest advantage is unlocking all the equity you’ve built up over the years. This lump sum can be a game changer, whether it’s for buying your next home in a suburb like Wilton, reinvesting somewhere else, or funding other life goals.

Of course, when you’re working out your potential profit, you have to subtract the costs from the sale price. These will include real estate agent commissions, your legal fees, and any money you spent getting the place ready for market, like home staging or minor touch-ups.

For many owners in suburbs like Brooklyn, Hataitai or Karori, selling in the current market can crystallise years of capital growth into a tangible financial gain, providing a clean slate without the ongoing responsibilities and risks of being a landlord.

To make things clearer, let’s break down the key financial points in a simple table.

Financial Snapshot: Renting vs Selling a Wellington Property

Here’s a comparative look at the financial side of things for a typical three-bedroom home in a suburb like Ngaio or Brooklyn, helping you see the numbers at a glance.

| Financial Factor | Keeping as a Rental | Selling the Property |

|---|---|---|

| Income Source | Consistent weekly/monthly rental payments. | One-off lump sum payment from the sale. |

| Primary Gain | Gradual equity growth (capital gains) and rental yield. | Immediate realisation of built-up equity. |

| Ongoing Costs | Rates, insurance, vacancies, maintenance, property management fees. | None after the sale is complete. |

| Upfront Costs | Initial setup, advertising for tenants, meeting compliance, decision-making. | Real estate commission, legal fees, marketing, home staging. |

| Tax Implications | Tax on rental income, but 100% mortgage interest deductibility from April 2025. | No capital gains tax (Bright-line test may apply). |

| Cash Flow | Potentially positive cash flow, but can be negative depending on mortgage and running costs. | Significant immediate cash injection. |

Ultimately, this table shows two very different financial paths. Renting is about building wealth slowly over time with a steady income stream, while selling is about cashing in on your investment for immediate financial freedom.

Navigating the Current Wellington Rental Market

Before you jump into being a landlord in Wellington, it’s crucial to get a feel for the rental landscape. Things have definitely shifted. The market has moved on from the landlord friendly conditions we saw a few years back, settling into something more balanced and in some pockets of the city, like Te Aro, Kingston and Newtown, it’s now a tenant’s market.

What’s driving this? A major increase in the number of rental properties available right across the city. This has really changed the dynamic for everyone involved, making it a much more competitive space for property owners.

The Impact of Increased Rental Supply

The biggest trend you need to be aware of is the simple surge in rental listings. The data is clear: there’s been a substantial jump in properties on the market, which means tenants have more choice than ever.

This oversupply has a direct knock-on effect on rental prices and how long your property might sit empty. In fact, Wellington saw a 10.9% drop in average rents compared to the previous year, with the median now sitting around NZD 636 per week. This correction is tied directly to an 82% rise in new rental listings, which naturally gives tenants more bargaining power.

For you, as a property owner, this means a house in a student area like Aro Valley or a family-friendly suburb like Johnsonville could stay vacant for longer if it isn’t priced and presented just right. You can get a deeper understanding of this by reading about why renting a property is taking significantly longer in today’s climate.

Strategies to Attract Quality Tenants

In a market where tenants can afford to be picky, making your property stand out is no longer optional. The days of putting in minimal effort and receiving a flood of applications are well behind us. Today, the most successful landlords are the ones who are proactive and strategic.

Here are a few practical ways to give your property an edge:

- Impeccable Presentation: First impressions count for everything. Your property must be clean, well-maintained, and genuinely inviting from the moment a potential tenant sees the listing. Through my professional network, I can connect you with trusted cleaners, gardeners, and painters for your consideration who can help make sure your property looks its absolute best.

- Consider a Pet-Friendly Policy: A huge number of good, responsible tenants in Wellington own pets and really struggle to find suitable homes. By advertising your place as “pets negotiable,” you can massively widen your pool of applicants and often find people who are keen to stay for the long term.

- Ensure Full Compliance: Meeting the Healthy Homes Standards is more than just a legal box to tick; it’s a massive selling point. Tenants are actively looking for warm, dry, and healthy homes, and showing that you’re a responsible landlord who cares about these things puts you well ahead of the competition.

In this market, properties in areas like Kelburn or Newtown need smart, effective marketing to avoid getting caught in seasonal lulls, especially during the quieter winter months. A proactive approach is absolutely key to keeping vacancy rates low and securing a great tenancy agreement.

Understanding the Wellington Property Sales Market

If you’re thinking about selling your property instead of navigating the rental market, it’s worth getting a feel for the current sales environment here in Wellington. The market has definitely shifted gears from the frantic pace of recent years past, settling into a much more balanced and sustainable rhythm.

This change brings both fresh opportunities and new things to think about for sellers. While the days of unconditional offers flooding in after a single open home might be less common, there’s still strong, consistent buyer interest for well-presented properties in great locations.

Current Market Dynamics for Sellers

Today’s market is all about more cautious and informed buyers. With the RBNZ’s Official Cash Rate influencing lending rates, buyers are taking their time, doing their homework, and really looking for homes that offer genuine value. This means pricing your property accurately from the get-go is more critical than ever.

For sellers, this new environment really rewards good preparation. A home in Wadestown or Mount Victoria that’s impeccably presented will always stand out and grab serious attention. The key is to meet the market where it is now, rather than where it was a couple of years ago.

The latest data paints a pretty clear picture of this balanced market. The median house price in Wellington has seen a moderate dip, down 4.4% year-on-year to around NZD 760,000. But here’s the interesting part: property sales volumes have actually grown by 12.8% compared to the previous year, showing it’s an active market.

In today’s more measured market, success really hinges on excellent presentation and smart pricing. Buyers have more choice, so making a powerful first impression is non-negotiable if you want to achieve a top sale price.

Preparing Your Property for a Successful Sale

With buyers being more selective, the way your home is presented can make all the difference. This is where a bit of professional prep can have a huge impact on your final sale price and how long your home spends on the market.

Whether you decide to sell now or in the future, it’s always a good idea to know the general strategies for how to increase home value before selling. Small improvements can often yield surprisingly big returns.

As a local real estate professional, I have a network of Wellington-based contacts for your consideration who can help with every aspect of getting your property ready. This includes professional stagers, gardeners, painters, and cleaners who know exactly how to make a property in suburbs like Thorndon or Northland appeal to today’s buyers. This support ensures your home is shown in its absolute best light, helping to capture buyer attention and create a competitive buzz. To get a better sense of local trends, you can explore our analysis of the current Wellington market conditions.

The Operational Realities of Being a Landlord

Being a landlord in Wellington is about much more than just collecting the rent each week. It’s an active, hands-on commitment, and before you decide to keep your property as a rental, it’s worth getting your head around the day-to-day realities.

The truth is, being a landlord can mean late-night calls about a leaking tap, trying to get your head around complex tenancy laws, and making sure your property is always up to scratch. It’s not what you’d call a passive investment it really does demand your time and energy.

Navigating Legal and Compliance Duties

One of the biggest hurdles is getting all the legal compliance right. This is absolutely non-negotiable. Here in New Zealand, every landlord must meet the strict Healthy Homes Standards, which cover everything from heating and insulation to ventilation and drainage.

On top of the national standards, Wellington has its own specific wrinkles. You’ll need to be across the city’s earthquake-prone building policies and double-check your land insurance is fit for purpose, especially with the local landslip risks in hillside suburbs like Roseneath or Wadestown.

Keeping on top of all these regulations is vital if you want to avoid fines and tenancy disputes down the track.

A well-managed property doesn’t just attract better tenants; it protects your investment. Overlooking your compliance duties can turn a valuable asset into a huge liability, fast.

The Demands of Tenant Management

Finding good tenants and keeping them happy is the other half of the job. The whole process involves:

- Thorough Screening: Doing proper background and reference checks to find reliable people who will hopefully stick around.

- Managing Tenancy Agreements: Making sure all the legal paperwork is buttoned down and correct.

- Handling Maintenance: Being ready to jump on repair requests, whether it’s a dripping tap or something more urgent.

- Regular Inspections: Carrying out inspections to make sure the property is being looked after.

These tasks take good communication and organisational skills. To make life easier, it’s worth investigating property management software that can help streamline things.

Ultimately, you need to ask yourself if you genuinely have the time and head space for self-management, or if handing it all over to a professional property manager is the smarter move. I know some of the best in the business and can connect you with trusted local managers from my network, helping you make a choice that actually fits your lifestyle.

Making Your Decision: A Situational Guide

Deciding whether to sell or keep your property as a rental isn’t a one-size-fits-all choice. Far from it. The right path for you hinges entirely on your personal circumstances, your financial goals, and frankly, how you want to live your life.

Let’s walk through a few common scenarios we see all the time here in Wellington to help bring some clarity to your decision.

The Accidental Landlord

This is a classic Wellington story. You’ve moved for a new job, or perhaps you’ve bought a new home with a partner, leaving your previous property in a suburb like Crofton Downs or Karori sitting empty. You never set out to be a landlord, and the thought of managing tenants, maintenance calls, and paperwork feels a bit overwhelming.

For the accidental landlord, selling is often the most practical choice. It provides a clean break and frees up a significant amount of capital, all while removing the stress of managing a property you no longer live in. That immediate financial gain can simplify your life in a big way.

The Aspiring Investor

The aspiring investor sees their property in a high-demand spot like Te Aro or Mount Cook as the first brick in a larger portfolio. You have a long-term vision for creating wealth and you’re prepared to take on the hands-on demands that come with being a landlord.

If this sounds like you, keeping the property as a rental is a logical next step. The rental income can help cover the mortgage while the property (hopefully) appreciates over time. The key here is making sure you have a solid financial buffer to handle unexpected costs and the inevitable vacancies between tenants.

The Downsizer or Retiree

We meet people in this situation often. They might own a large family home in a suburb like Khandallah or Wadestown and are simply ready for a simpler, lower-maintenance lifestyle. Their main priority is to unlock the equity they’ve painstakingly built over decades to fund their retirement and enjoy their freedom.

For the downsizer, selling is almost always the best move. It converts their largest asset into liquid funds, which provides immense financial security and flexibility for the years ahead. The proceeds can be used to buy a smaller home, invest for income, or simply enjoy life without the responsibilities of a large, empty house.

No matter which category you fall into, the decision is a deeply personal one. For a friendly, confidential chat about your specific situation and to get a clear understanding of your property’s current value in today’s market, please feel free to reach out for a complimentary appraisal.

Your Top Questions Answered

We get asked these questions all the time, so let’s tackle them head-on. Here are some straight-up answers to the big questions Wellington property owners are wrestling with right now.

How Do the Interest Deductibility Changes Really Affect My Rental?

The return of mortgage interest deductibility is definitely a win for landlords on paper. It’s designed to lower your taxable income, which can certainly help the cash flow. It’s a powerful incentive that makes holding a rental more appealing from a tax standpoint.

But here’s the reality check: you have to weigh that tax benefit against what’s happening on the ground in Wellington. With rent growth pretty flat and a lot more properties up for grabs, the risk of your place sitting empty for longer is real.

To know how it truly affects your bottom line, you need to run the numbers on your specific property. It’s all about balancing a good tax rule with the actual market conditions.

Is This a Good Time to Sell in My Part of Wellington?

Most people are calling the Wellington market ‘balanced’ at the moment. What that means for you is there are good opportunities out there, but only for properties that are well-presented and priced realistically. Prices might have cooled off a bit from the absolute peak, but we’re still seeing healthy sales activity across the city.

Honestly, the ‘best’ time to sell comes down to your own goals and what the demand is like in your neighbourhood, whether that’s a family looking for a home in Wilton or someone after a character villa in Northland or Hataitai. Buyers are feeling positive but they’re not rushing into things, so a smart strategy is essential.

The most reliable first step is to get a professional market appraisal. I can provide a complimentary one, which will give you the hard data you need to see what your property is genuinely worth today and make a clear decision.

What Are the Biggest Hidden Costs I Should Know About as a First-Time Landlord?

If you’re new to the landlord game, there are three costs that often catch people by surprise: ongoing maintenance, the cost of an empty property, and keeping up with compliance.

- Maintenance: A lot of Wellington’s housing stock is older, and when you combine that with our climate, things need regular upkeep. It adds up.

- Vacancy: An empty property still has bills. You’re covering the mortgage, council rates, and insurance out of your own pocket with zero rent coming in.

- Compliance: Getting your property up to scratch with all the legal standards, like the Healthy Homes rules, can mean spending a decent amount of cash upfront.

Budgeting for these things from day one is absolutely crucial if you want to be a successful landlord without all the stress. Factoring these potential costs into your financial plan right from the start will save you a world of headaches later on.

The most reliable first step is to get a professional market appraisal. I can provide a complimentary one, which will give you the hard data you need to see what your property is genuinely worth today and make a clear decision.

.

.

.

.

.

.

.

.

.

.

.

.

.

Disclaimer: The real estate content shared on this blog is intended for general informational purposes only and industry observations. The content may reflect personal views or reference third-party sources, but it is not a substitute for tailored professional advice. Real estate decisions often involve legal, financial, and regulatory complexities, and readers should seek independent guidance from qualified specialists such as legal advisors, financial consultants, or compliance professionals before acting on any information presented here. No warranty is given as to the accuracy, completeness, or current relevance of the material.