Thinking about selling your Wellington home? Understanding the mortgage market is a big piece of the puzzle. As of 5 December 2025, interest rates seem to have found a stable footing. This is creating a confident mood for buyers and sellers across the city.

Your Wellington Property Market Snapshot

If you plan to sell your home, the financial landscape is key. Today’s mortgage rates directly impact buyers. This is true for first-home hunters in Newlands. It is also true for families upgrading in Karori. This snapshot gives you a clear and simple overview. We will look at current interest rates. We will see how they shape what buyers do. Most importantly, we will see what that means for you. Knowing these details helps you position your property well. It also helps you feel confident in your decisions. As a local Wellington real estate professional, my name is Halina. I see how buyers in areas like Brooklyn and Ngaio react to lending conditions. My goal is to use this insight to help you get the best result.

How Today’s Rates Help You Sell

A stable market is great news for sellers. After some ups and downs, rates are now steady. This encourages more buyers to make a move. For you, this means more potential interest in your home. It could be a modern apartment in Te Aro. It could also be a classic villa in Thorndon. A steady flow of pre-approved buyers can lead to a great sale price. Understanding this helps you see the opportunity in today’s market.

An experienced agent like me, Halina, can help you navigate this. I use my knowledge of the Wellington market to your advantage. We can work together to attract these ready-to-go buyers. A quick chat can clarify how these conditions can benefit your sale.

A Guide to Mortgage Types for Sellers

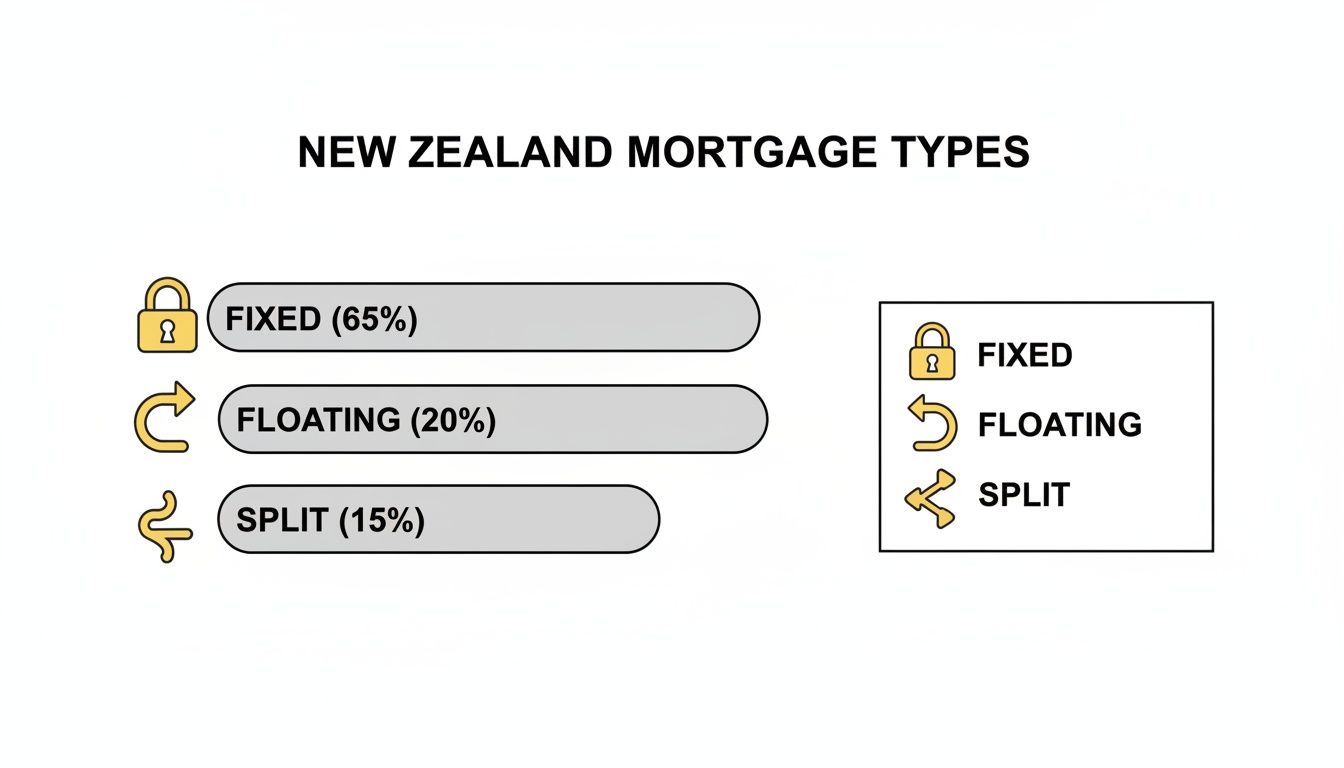

When selling your home, it helps to think like a buyer. Understanding their finances gives you an advantage. It helps you understand their offer and their buying power. Most Kiwi buyers use a few common mortgage types. Knowing the basics makes the selling process much clearer for you.

The Main Mortgage Types Explained

Here are the most common options buyers in Wellington consider:

- Fixed-Rate Mortgage: This is the most popular choice. The interest rate is locked in for a set time. This is usually one to five years. It gives buyers certainty about their repayments. It makes their budgeting easy.

- Floating-Rate Mortgage: With this, the interest rate moves with the market. It offers more flexibility. Buyers can often make extra payments without penalty. But their repayments can change. They need to budget for potential increases.

- Split Mortgage: This is a ‘best of both worlds’ approach. A buyer fixes part of their loan. They leave the rest on a floating rate. It gives them some certainty and some flexibility.

Common New Zealand Mortgage Types

Here’s a simple table to show how these loans compare.

| Mortgage Type | How It Works | Best For… |

|---|---|---|

| Fixed Rate | Rate is locked for a set term. Repayments stay the same. | Buyers who need budget certainty. |

| Floating Rate | Rate moves with market changes. Repayments can change. | Buyers who want to make extra payments. |

| Split Loan | Part of the loan is fixed. The rest is floating. | Buyers who want security and flexibility. |

This knowledge gives you an edge as a seller. A buyer with a fixed-rate pre-approval is often ready to act. They know their budget. This can lead to clean, decisive offers on properties in places like Aro Valley or Karori. This insight helps me, Halina, give you solid advice on how to position your home. We can make your property the one they can’t wait to sign for.

Current NZ Interest Rates: December 2025

Let’s look at current interest rates. They give a real feel for the property market. As we near the end of 2025, the lending scene looks positive. This is fantastic news if you are thinking of selling. This stability gives buyers the confidence they need to act. Here’s a snapshot of the special rates from major banks.

Major NZ Bank Mortgage Interest Rates: December 2025

| Bank | 1-Year Fixed | 2-Year Fixed | 3-Year Fixed | 5-Year Fixed |

|---|---|---|---|---|

| ANZ | 4.45% | 4.49% | 4.55% | 4.79% |

| ASB | 4.45% | 4.49% | 4.59% | 4.89% |

| BNZ | 4.45% | 4.49% | 4.59% | 4.89% |

| Kiwibank | 4.45% | 4.49% | 4.59% | 4.89% |

| Westpac | 4.45% | 4.49% | 4.59% | 4.89% |

| TSB | 4.39% | 4.55% | 4.65% | 4.95% |

| Source: interest.co.nz, rates are subject to change. |

As you can see, the market is competitive. TSB has the lowest 1-year fixed rate at a sharp 4.39%. Most major banks offer 4.49% for a 2-year term. This shows just how active things are. These rates are much lower than the peaks we saw in the past. It shows the market has settled.

The strong preference for fixed rates tells us buyers want certainty. This is a positive sign of a stable market. It means more confident buyers are looking at properties in suburbs like Wadestown and Crofton Downs. As your agent, I use this knowledge to help attract these serious buyers to your home.

Partner with a Local Expert for Great Results

Having a local expert on your side makes a real difference. The current market stability is bringing out confident, pre-approved buyers. This creates fantastic opportunities for homeowners.

As a local Wellington real estate professional, I am Halina. I bring years of on-the-ground experience to your sale. My knowledge of our unique suburbs, from Te Aro to Khandallah, helps connect your property with the right people. My approach is to make selling clear and stress-free for you. My goal is simple: to help you achieve a brilliant result.

If you are curious about what your home might be worth, let’s talk. A complimentary property appraisal will give you a clear picture of its value in today’s active market. I also have a great network of professionals. They can help with cleaning, gardening, or painting. They can get your home looking its absolute best. Please feel free to reach out to me, Halina, to discuss your plans.

You can book your free appraisal right here >, let’s talk or call me now 📱+64212263917

Contact Halina today to discover your home’s full potential.

.

.

.

.

.

.

.

.

.

.

Disclaimer: The real estate content shared on this blog is intended for general informational purposes only and industry observations. The content may reflect personal views or reference third-party sources, but it is not a substitute for tailored professional advice. Real estate decisions often involve legal, financial, and regulatory complexities, and readers should seek independent guidance from qualified specialists such as legal advisors, financial consultants, or compliance professionals before acting on any information presented here. No warranty is given as to the accuracy, completeness, or current relevance of the material.