Jumping into the New Zealand property market without a clear plan is like trying to navigate Wellington’s windy streets blindfolded. Success doesn’t start with a property search; it begins with a solid strategy. You need to figure out your financial goals—are you after long-term capital growth or immediate rental income?—and get a real grip on your borrowing power before you even glance at a listing. This groundwork ensures every move you make is part of a bigger, smarter picture, especially in the unique Wellington market.

Setting Your Foundation for Wellington Property Investment

Before you get carried away with open homes in sought-after Wellington suburbs like Karori or Te Aro, the most important work happens first. This isn’t about browsing Trade Me Property; it’s about defining what a “win” looks like for you and then making sure your finances can actually get you there.

So, the first question to ask yourself is simple: what’s my main goal here? Are you hoping to see long-term capital growth from a classic villa in Khandallah? Or do you need the immediate, steady cash flow that a modern apartment in Te Aro could provide? Your answer to this question will shape every single decision that follows.

Define Your Investment Strategy

Your personal situation is the best guide for choosing the right path. Generally, property investment returns come from two main avenues:

- Capital Growth: This is all about buying in areas where property values are expected to climb over time. An investor playing the long game might look at a family home in a suburb with great school zones, like Ngaio or Wadestown, banking on consistent demand to push up its value over the next ten years.

- Rental Yield (Cash Flow): This approach is laser-focused on properties that bring in more rent than what it costs to hold them (think mortgage, rates, and insurance). A multi-unit townhouse in a high-demand rental spot like Johnsonville or Newtown, close to the hospital and university, is a perfect example of a yield-focused play.

Of course, many seasoned investors look for the sweet spot—a property that delivers a decent rental return and has solid prospects for future growth. A well-kept two-bedroom unit in Brooklyn or Vogeltown, popular with young professionals, could be just the ticket for this balanced approach.

Conduct a Personal Financial Health Check

Once you know your goal, it’s time for a frank conversation with your bank account. This is more than just checking your savings balance; it’s about understanding your true capacity in today’s market.

First up, work out your usable deposit. And remember, the rules are different for investors. Banks in New Zealand often require a much larger deposit for investment properties—you’ll likely need 35% or more of the purchase price, not the standard 20% for an owner-occupier.

Next, you need to know your borrowing power. This is where a good mortgage broker becomes your best friend. They can dive into your income, expenses, and any existing debts to give you a realistic pre-approval figure. This number is your hard limit and saves you from wasting time and emotional energy on properties you can’t afford.

A rookie mistake is underestimating the ongoing costs. It’s not just the mortgage. You have to budget for Wellington council rates, insurance (including those EQC and land insurance nuances), maintenance, and maybe even property management fees. Factoring these in from day one is what makes an investment resilient.

Understanding the Wellington Property Landscape

The NZ property market has something for everyone, and each option has its pros and cons. A standalone house in a suburb like Northland gives you land and potential for future development, but it often comes with higher maintenance headaches. On the other hand, a new-build townhouse in Newlands might mean less maintenance and appeal to tenants wanting modern comforts, but you’ll have less land.

To really get your head in the game, it’s worth checking out some effective strategies for investing in rental property to get a broader perspective. This initial research isn’t just busywork; it’s about creating your strategic blueprint. Without it, you’re just browsing. With it, you’re investing.

Securing Finance and Navigating the Legal Maze

Getting your finances sorted and understanding the legal side of a property purchase are often the biggest hurdles for new investors. It can feel a bit overwhelming, but when you break it down into clear, manageable parts, it’s much more approachable.

Let’s walk through what you need to do to secure your funding and handle the legal requirements with confidence.

The first move is always to secure pre-approval for your mortgage. This isn’t just a suggestion; it’s a critical step that transforms you from a window shopper into a serious buyer. Pre-approval tells you exactly what you can borrow, giving you the power to make firm offers on properties anywhere from Thorndon to Berhampore.

What Lenders Look for in Investors

When you’re applying for an investment loan, lenders are going to scrutinise your application a bit differently than they would for someone buying their own home. They’re assessing the risk not just on you, but on the viability of the investment itself.

They’ll want to see:

- A substantial deposit: As an investor, you’ll generally need a minimum of 35% of the purchase price.

- Strong, consistent income: Lenders need to see that you can comfortably service the new mortgage, even if the property were vacant for a little while.

- A clean credit history: Any past issues can be a red flag, so it pays to check your credit score beforehand.

- Existing equity: If you already own property, the equity you hold can significantly strengthen your application.

This focus on investor lending is a huge part of the market. During the first five months of the year, over 93,000 new residential mortgages were issued in New Zealand. A significant chunk of that, 22%, was directed towards investment properties and business purposes.

Understanding Your Loan Structure

Once you have pre-approval, you need to think about your loan structure. The main choice is between a fixed or floating interest rate, and a lot of savvy investors actually use a combination of both.

- Fixed Rate: This locks in your interest rate for a set term (e.g., 1-5 years). It gives you certainty around your repayment amounts, which is fantastic for budgeting.

- Floating (or Variable) Rate: The interest rate moves up or down with the market. This offers more flexibility—you can make extra payments without penalty—but it does come with less certainty.

Many investors choose to “split” their loan. They’ll fix a portion for stability and leave a smaller amount on a floating rate for flexibility. It can be a smart way to manage risk while still having the ability to pay down debt faster if you’re in a position to do so.

The Legal Essentials for Wellington Investors

With finance pre-approved, your focus shifts to the legal process. A good solicitor who specialises in property law is non-negotiable. Think of them as your expert guide and protector throughout the whole transaction.

Your solicitor will handle several critical tasks, but their most important role is reviewing all the property documents before you sign anything. This is your due diligence period.

In Wellington, due diligence goes beyond the standard checks. Your solicitor must carefully review the Land Information Memorandum (LIM) report for any mention of earthquake-prone building (EPB) notices or natural hazard information. This is particularly relevant for properties in suburbs like Mount Victoria, Thorndon or Roseneath.

They will also go through the Sale and Purchase Agreement with a fine-tooth comb to ensure the conditions protect your interests. This includes checking the property title for any easements or covenants that could restrict how you use the land.

For landlords, it’s also absolutely crucial to understand your obligations from day one. You can read our detailed guide on the latest New Zealand Healthy Homes Standards to make sure you’re fully compliant. Getting this legal groundwork right provides the peace of mind you need for a successful long-term investment.

Conducting Hyper-Local Market Research in Wellington

Forget what the national news is saying. Smart property investment in Wellington is won on the ground, with deep, hyper-local knowledge. To make the right call, you need to become an expert on the specific Wellington suburb you’re eyeing up – whether that’s the leafy streets of Wilton, the convenient buzz of Northland, or the established appeal of Wadestown.

This means you’ve got to move past the broad market chat and get your hands dirty with the data that really counts. You’ll be analysing recent sales, getting a feel for buyer demand on a street-by-street basis, and understanding the unique vibe of each neighbourhood. A place in Aro Valley aimed at students has a totally different investment profile to a family home out in Karori.

Uncovering Local Trends and Data

Your first job is to hunt down solid data on rental yields and vacancy rates. This is how you’ll accurately forecast your returns. Look for trends in specific types of properties. Are two-bedroom units in Berhampore being snapped up faster than standalone houses? Getting into this level of detail is how you find where the real demand is.

After a bit of a rollercoaster, the Kiwi housing market is showing signs of a steady recovery. Wellington, in particular, has begun to find its feet, with recent data showing median house prices sitting around NZD 844,600. This stability is partly thanks to first-home buyers staying active in the more affordable suburbs, plus an increase in townhouse supply which is creating more choice.

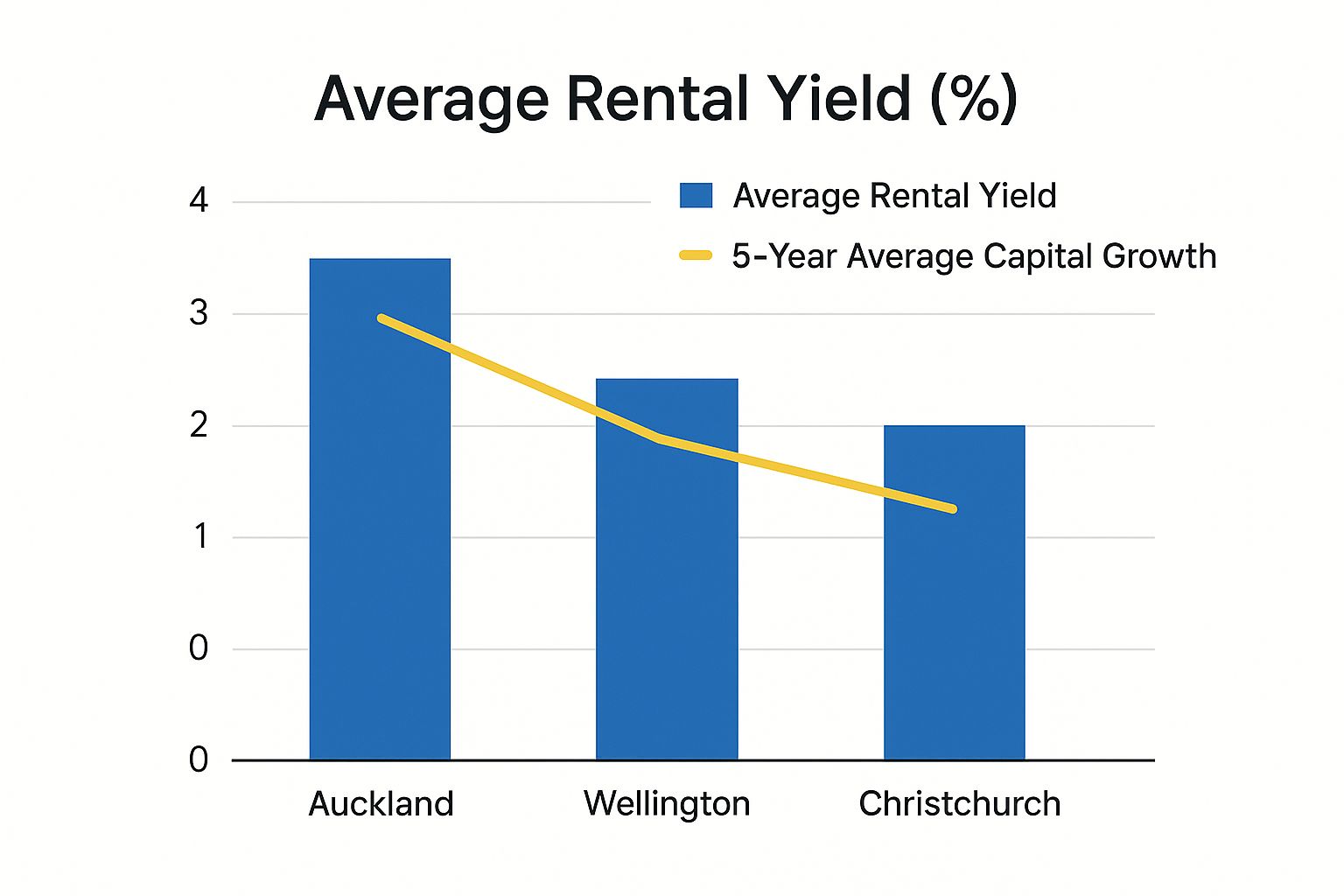

The infographic below gives you a high-level look at how rental yields and capital growth stack up across the main NZ cities. It’s a great starting point for your research.

As you can see, different markets strike a different balance between immediate cash flow from rent and long-term value appreciation. This just reinforces why you need to drill down into the local scene.

Looking Beyond the Current Numbers

Historical data is one thing, but the best investors are always looking ahead. This means digging into a neighbourhood’s future potential by looking at things that don’t always show up in today’s sale prices.

A few key areas to get your teeth into:

- Wellington City Council Zoning: Are there proposed changes that could allow for more intensive housing in an area like Crofton Downs or Ngaio? This could seriously impact future supply and values.

- Infrastructure Projects: Is a new bus route or public park planned for Johnsonville or Newlands? Projects like these can give a suburb’s appeal a massive boost.

- Earthquake Strengthening: In central spots like Te Aro and Thorndon, the status of earthquake-prone buildings can have a big say on insurance costs and future liabilities. Getting your head around these details is crucial.

For a detailed breakdown of the latest figures, feel free to explore our analysis of the most recent monthly NZ sales statistics from REINZ.

Smart investors don’t just buy what a suburb is today; they invest in what it’s poised to become tomorrow. Local council plans and infrastructure announcements are your roadmap to future growth potential.

Wellington Suburb Investment Snapshot

To help you see how this works in practice, we’ve put together a quick comparison of a few popular Wellington suburbs. This table gives you a snapshot of what to expect, helping you match a location to your own investment goals.

| Suburb | Median Price (Approx.) | Average Rental Yield | Primary Tenant Profile | Key Local Amenity |

|---|---|---|---|---|

| Mount Cook | $650,000 | 5.0% – 5.5% | Students, hospital staff, young professionals | Massey Uni, Wellington Hospital |

| Karori | $950,000 | 3.5% – 4.0% | Families, professionals | Excellent schools, Karori Park |

| Johnsonville | $780,000 | 4.0% – 4.5% | Commuters, young families | Johnsonville Mall, transport hub |

| Island Bay | $1,100,000 | 3.0% – 3.5% | Established families, professionals | Beach, local cinema, strong community |

| Wadestown | $1,250,000 | 3.0% – 3.5% | Professionals, established families | Premier schooling, village feel, city proximity |

As you can see, an apartment in Mount Cook offers a steady stream of tenants from the university and hospital, promising a strong rental yield. In contrast, a family home in Wadestown might offer lower immediate returns but holds the promise of solid long-term capital growth, thanks to its great schools and community feel.

Understanding these micro-markets is absolutely key. When you combine hard data with on-the-ground insights, you can confidently pinpoint the Wellington suburbs that are the perfect match for your investment strategy.

From Property Search to Getting the Keys

Finding and securing the right investment property is a journey. It takes more than just scrolling through online listings late at night. The real art lies in navigating the whole acquisition process—from spotting those hidden gems to confidently negotiating the final terms. This is where all your detailed research finally meets real-world action.

We’ll walk you through the most effective search tactics, how to inspect a property with an investor’s eye, and what it takes to come out on top in different sale environments. Let’s map out the path from making that first offer to finally getting those keys in your hand.

Beyond the Online Portals

While property websites are a decent starting point, the best deals are often found elsewhere. Honestly, one of the most powerful things you can do is build strong relationships with local real estate agents. An agent who genuinely understands your investment goals can alert you to off-market deals before they ever hit the public domain.

Make a habit of attending open homes in your target suburbs, even for properties slightly outside your budget. Introduce yourself to the agents, be specific about what you’re after—a two-bedroom in Vogeltown with reno potential, for example—and ask to be added to their database. This proactive approach really puts you on their radar.

Your Property Viewing Checklist

When you walk into a property, you need to look past the fresh paint and staged furniture. Your job is to spot both the potential red flags and the hidden opportunities that others might miss.

Here’s a practical checklist to keep in mind during inspections:

- Look for Structural Clues: Keep an eye out for cracks in walls (especially around windows and doors), uneven floors, or that musty smell that hints at dampness. In Wellington, pay very close attention to the foundations and any retaining walls.

- Assess the Big-Ticket Items: How old are the roof, wiring, and plumbing? Replacing these can be a massive expense that will absolutely destroy your returns.

- Consider the Neighbours: Take a quick look at the condition of the neighbouring properties. Tidy, well-maintained homes next door can have a positive influence on your property’s value.

- Evaluate the Orientation: Which way does the house face? A north-facing living area that gets all-day sun is a huge selling point for tenants, especially during Wellington’s cooler months.

Making an Offer and Navigating the Sale

How a property is sold—by auction, tender, or negotiation—completely dictates your strategy. An auction, for example, requires you to have all your due diligence done and finance approved before you even think about bidding. A successful bid results in an unconditional contract, right then and there.

In contrast, a negotiation or tender gives you a bit more breathing room to submit a conditional offer. This might include clauses making the sale subject to a satisfactory builder’s report, securing finance, or getting your solicitor’s approval on the LIM.

Wellington’s property market definitely has its own rhythm. Buyer urgency often picks up in spring and autumn, while the winter months can sometimes present opportunities with fewer competing buyers. Adjusting your strategy to these seasonal shifts can give you a real edge.

The Settlement Process Explained

Once your offer is accepted and all conditions have been met, the contract goes unconditional. This kicks off the settlement period, which is typically around 4-6 weeks. During this time, your solicitor handles all the legalities of transferring ownership.

On settlement day, your lender pays the remaining balance to the seller’s solicitor. Once the funds have cleared, you’ll get that exciting call from the agent to confirm the sale is complete. This is the moment you’ve been working towards—it’s time to collect the keys and officially take ownership of your new investment.

Managing Your Wellington Investment for Maximum Returns

Getting the keys to your new investment property is a massive achievement, but honestly, it’s just the starting line. The real work—and where you actually make your money—comes down to smart, proactive management. This is the part where your property stops being just a house and starts being a high-performing business that brings in consistent returns.

Successfully managing a rental in Wellington is about so much more than just banking the rent each week. It’s a game of protecting your asset, staying on the right side of a long list of legal duties, and building a good, solid relationship with your tenants. Nailing this part is what separates a stressful, money-draining liability from a successful long-term investment that works for you.

To Self-Manage or Hire a Professional

One of the first big calls you’ll have to make is whether to manage the property yourself or to get a professional property manager on board. There are pros and cons to both, and the best choice really comes down to where you live, what you know, and how much time you can realistically pour into it.

- Self-Management: Going it alone gives you total control and saves you the management fee, which usually sits around 7-10% of the rent. But—and it’s a big but—it means you’re on the hook for everything. That includes finding tenants, doing inspections, and dealing with that call about a burst pipe at 10 pm on a Saturday night. If you live here in Wellington and have the time and know-how, it can definitely work.

- Professional Management: A good property manager lives and breathes the Residential Tenancies Act. They’ll handle the tenant screening, chase up rent, sort out maintenance, and make sure your property is up to scratch with all the legal standards, like the Healthy Homes rules. For investors who live out of town or just have busy lives, their fee is often worth every cent for the peace of mind.

Understanding Your Legal Duties as a Landlord

Being a landlord in New Zealand comes with a hefty set of legal responsibilities. If you drop the ball on these, you could be facing some pretty serious fines from the Tenancy Tribunal, so you absolutely have to know the rules.

Some of your key duties include:

- Bond Lodgement: Any bond a tenant pays must be lodged with Tenancy Services within 23 working days. No excuses.

- Healthy Homes Standards: Your property has to meet specific standards for heating, insulation, ventilation, and dealing with moisture and drainage.

- Maintenance: You’re legally required to keep the place in a reasonable state of repair and jump on maintenance requests quickly.

Remember, these aren’t just ‘nice-to-haves’; they are legal requirements. Keeping up with tenancy law is non-negotiable and protects both you and your tenants.

Tenant Selection and Rent Setting

Finding fantastic tenants is the absolute bedrock of successful property management. A rock-solid screening process—we’re talking reference checks, credit checks, and a proper interview—is essential. You’re looking for people who will not only pay the rent on time but also treat your property with respect.

Setting the right rent is just as crucial. You need to find that sweet spot between maximising your income and staying competitive enough to attract good tenants quickly. To make sure you’re getting the most out of your investment, it’s vital to have a clear picture of your income. An excellent external tool can help you Calculate Rental Income Like a Pro to ensure your numbers are bang on.

Once you have a handle on the income side, you can properly assess your overall returns. For a deeper dive, learn more about calculating rental returns in Wellington with our detailed guide. This will help you see how your property is stacking up against the goals you set in the beginning.

Common Questions About Wellington Property Investing

When you’re looking at investing in property in Wellington, it’s totally normal for questions and a few myths to start swirling around. Let’s get stuck into some of the most common queries we hear from local suburbs like Aro Valley, Berhampore, Brooklyn, Crofton Downs, Johnsonville, Karori, Kelburn, Khandallah, Newtown, Ngaio, Thorndon, Wadestown, and Wilton so you can move forward with confidence.

Myth-Busting & FAQs

Is now a good time to sell in Karori?

This is the big one every investor asks. The most honest answer? It’s far more about your long-term strategy and personal circumstances than trying to nail the perfect market timing. While the market will always have its ups and downs, Wellington’s fundamental strengths—like being the hub for government and business—give it a solid foundation for long-term stability. Suburbs like Karori and Khandallah have an enduring appeal for families thanks to their fantastic schools and community feel, which keeps demand consistently strong. Forget “timing the market”; successful investors know it’s all about “time in the market.”

The best way to understand if a specific opportunity is right for you now is with solid data. A detailed property appraisal cuts through the noise, revealing the current value and potential of a property. It lets you make a decision based on facts, not speculation.

How much is my Wellington home worth?

The value of a home in suburbs like Wadestown, Northland, or Wilton is influenced by recent comparable sales, current buyer demand, and specific features of the property itself. Online estimates can provide a rough guide, but for an accurate, data-driven valuation that considers hyper-local trends, you need a professional appraisal from an agent who specialises in these areas.

Do I need to stage my home to sell in Wellington?

While not always essential, professional home staging can make a significant difference, especially in competitive suburbs like Thorndon or Mount Victoria. Staging helps potential buyers visualise themselves living in the space, can highlight the home’s best features, and often leads to a quicker sale at a better price. It’s particularly effective for vacant properties or those with dated furniture. The decision often comes down to the specific property and target market.

Do I really need a LIM report for a Wellington investment property?

Yes. Absolutely. A Land Information Memorandum (LIM) report is a non-negotiable part of your due diligence when you’re buying in Wellington. This is the official council-issued report that uncovers critical details you just can’t see during a walkthrough. A LIM will show you things like zoning rules, consents for any past work, and potential hazards like flood risks. Given Wellington’s unique geography and seismic activity, understanding any notes about earthquake-prone buildings (EPBs) or landslip risks is absolutely vital for protecting your investment.

Final Thoughts & Your Next Step

Investing in Wellington property is a significant step, but with the right local knowledge and a clear strategy, it can be an incredibly rewarding journey. Understanding the unique character of suburbs from Island Bay to Johnsonville, and staying on top of local regulations, is key to your success.

Ready to find out the true potential of your property or discuss your investment goals? Book a no-obligation, free appraisal today and let’s create a winning strategy together.

.

.

.

.

.

.

.

.

Disclaimer: The real estate content shared on this blog is intended for general informational purposes only and industry observations. The content may reflect personal views or reference third-party sources, but it is not a substitute for tailored professional advice. Real estate decisions often involve legal, financial, and regulatory complexities, and readers should seek independent guidance from qualified specialists such as legal advisors, financial consultants, or compliance professionals before acting on any information presented here. No warranty is given as to the accuracy, completeness, or current relevance of the material.