Trying to get your head around interest rates can feel a bit complicated, but how they affect your property goals is actually quite straightforward. As a Wellington real estate professional, I see the real-world impact of these changes every day, from Khandallah to Miramar.

Quick note before we jump in: The information here is just for general interest, it’s not official advice. Some of it’s based on opinion or pulled from property news sources that share useful tips, we do our best but we can’t guarantee it’s all spot-on or fully complete.

It all starts with the Official Cash Rate (OCR), which is set by the Reserve Bank of New Zealand. Think of the OCR as the wholesale cost of money for the banks; it’s the main lever that influences the mortgage rates banks end up offering you.

So, when the OCR moves up or down, it has a direct knock-on effect. It impacts how much you can borrow as a buyer in Ngaio, and it also changes the number of potential buyers who might be looking at your home in Te Aro.

How Interest Rates Influence Your Property Goals

This guide is here to demystify these concepts and turn confusing economic news into practical, useful knowledge for your own Wellington property journey. As you map out your next move in suburbs like Wilton, Hataitai or Mount Cook, understanding how interest rates interact with your finances is absolutely key.

Knowing how much you need to save up is also a huge piece of the puzzle. Our guide on how much deposit you need to buy a house in NZ can help make that part of the process much clearer.

As a local expert, my goal is to help you navigate these market shifts and make decisions you feel truly confident about. I’m here to ensure you’re well-prepared to achieve your real estate goals, whatever they may be.

The OCR’s Impact on Wellington Buyers and Sellers

The Reserve Bank’s Official Cash Rate (OCR) is the invisible hand that shapes the day-to-day reality of Wellington’s property market. It’s the tool the RBNZ uses to steer the economy, and its movements have a direct ripple effect on what buyers and sellers experience on the ground.

For instance, think about a family looking to buy their first home in Brooklyn. If the OCR goes up, their potential mortgage payments suddenly get higher, which might shrink their budget or even push their dream home out of reach.

On the flip side, an OCR cut can inject a huge dose of confidence into the market. Suddenly, borrowing is cheaper, which can fire up buyer competition for a two-bedroom apartment in Mount Victoria. If you’re a seller in areas like Northland or Vogeltown, that’s exactly the kind of environment you want.

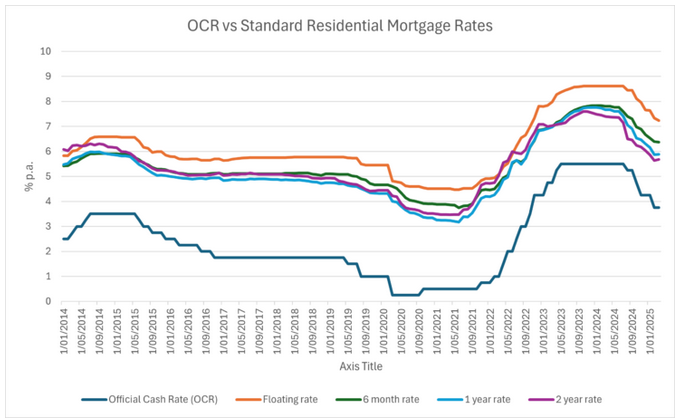

This chart gives you a great visual on just how much interest rates have changed over the decades.

As you can see, despite recent hikes, the long-term trend for benchmark rates has been downwards. These shifts are what drive market sentiment, and you can get more of my thoughts on the local market in the latest property commentary.

Strategies for Selling in Any Rate Environment

So, you’re wondering, “Is now a good time to sell in my area?” It’s a common question, and the answer often comes down to focusing on what you can actually control.

The truth is, whether interest rates are high or low, presenting your property at its absolute best is non-negotiable. It’s the one constant in any market.

A well-marketed home in Khandallah or a beautifully staged apartment in Thorndon will always attract serious buyers, regardless of the OCR. These are the strategies that make your property stand out. For more insights on this, you can explore the latest Wellington property market trends on our blog.

As your local professional, I have built a network of contacts over the years, from painters to gardeners, all ready to help prepare your home for a successful sale and ensure you get the best possible result.

What’s Your Next Move in the Wellington Market?

While it’s easy to get caught up in the headlines about interest rates, they’re only one piece of the puzzle. What really matters are your own circumstances and the unique dynamics of your local neighbourhood.

Whether you’re settled in a family-friendly spot like Karori or love the vibrant energy of Newtown, the smartest move is always an informed one. The best next step is getting advice that’s built around you.

I’m Halina, and I’m here to help you figure that out. You can reach out for a friendly, no-pressure chat, a complimentary property appraisal, or you can download my free guide to selling in Wellington.

Let’s map out a clear path forward together, so you can feel confident and supported every step of the way.

FAQs: Your Top Questions Answered

I get asked about interest rates all the time. Here are some of the most common questions from Wellington buyers and sellers, along with straightforward answers.

Should I Wait for Rates to Drop Before Selling?

Not necessarily. It’s easy to get caught up trying to time the market perfectly, but the truth is, a quality, well-presented home in a sought-after suburb like Karori or Brooklyn will always attract genuine interest. Waiting could also mean you’re up against more listings when they do fall, increasing competition. Sometimes, the best time to sell is simply when it’s right for you.

How Do Fixed vs Floating Rates Affect Me?

Think of it like this: a fixed rate is your safety net. You lock in your rate for a set period, giving you certainty for your budget. A floating rate, on the other hand, moves with the market. Banks will stress-test your finances at a higher rate to ensure you can handle any potential increases.

Does the OCR Directly Set My Mortgage Rate?

Not directly, but it has a huge influence. The OCR sets the baseline cost of borrowing for banks. When the Reserve Bank changes the OCR, banks almost always adjust their own mortgage rates, passing that change on to you.

.

.

.

.

.

.

.

.

.

.

.

.

.

Disclaimer: The real estate content shared on this blog is intended for general informational purposes only and industry observations. The content may reflect personal views or reference third-party sources, but it is not a substitute for tailored professional advice. Real estate decisions often involve legal, financial, and regulatory complexities, and readers should seek independent guidance from qualified specialists such as legal advisors, financial consultants, or compliance professionals before acting on any information presented here. No warranty is given as to the accuracy, completeness, or current relevance of the material.