Owning a property through a family trust is incredibly common across Wellington, whether it’s a sprawling family home in Karori or a tidy investment apartment down in Te Aro. But what does that actually mean when it’s time to put a ‘For Sale’ sign up? As Wellington City’s local real estate expert, Halina of Ray White, I want to break down what you need to know. With over 30 years of extensive sales experience, I’ve helped countless families navigate this process, and I’m here to offer professional advice when you’re thinking of selling real estate.

What Is a Family Trust?

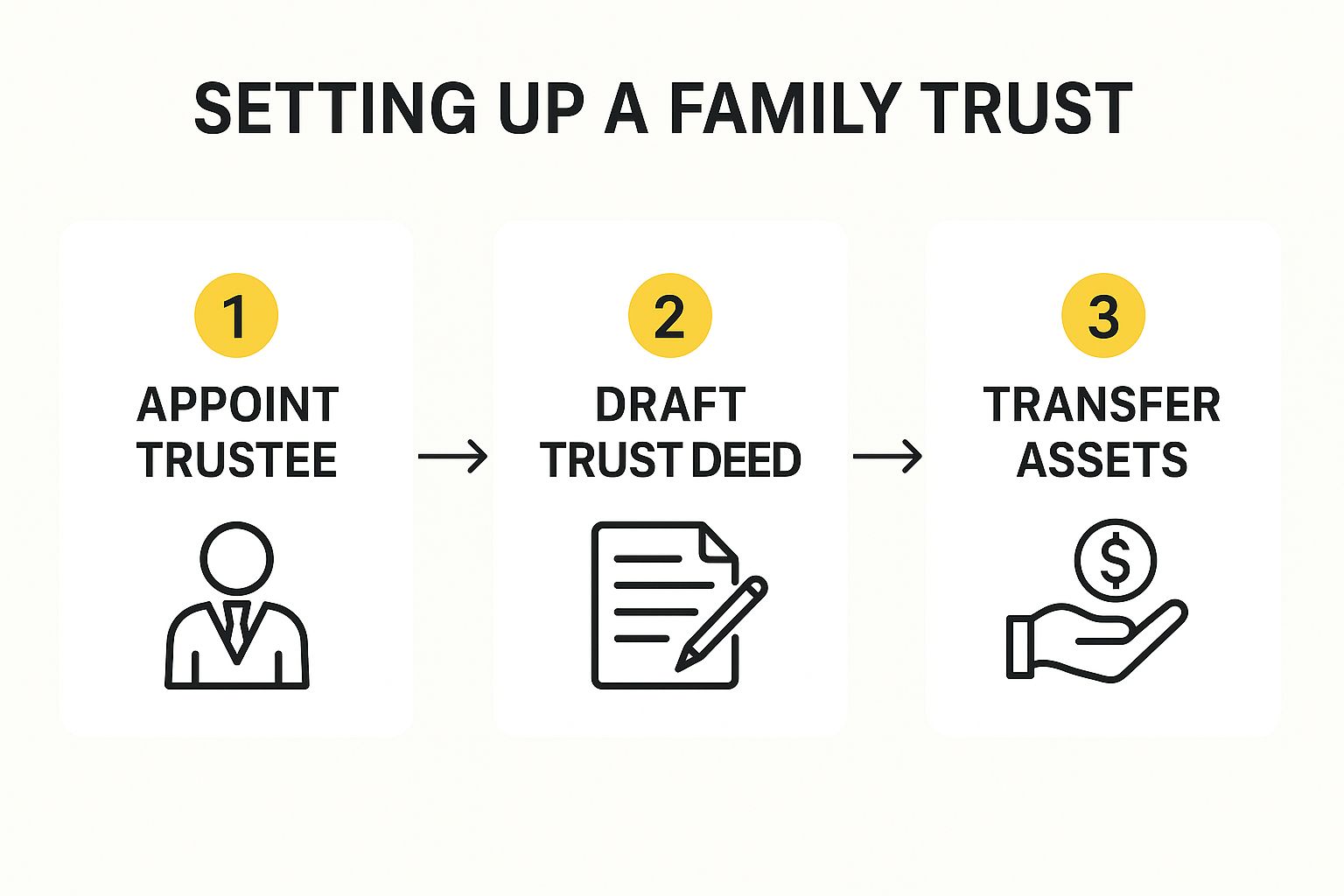

Let’s cut through the jargon. A Family Trust isn’t a company; it’s a formal relationship set out in a legal document called a Trust Deed.

- Settlor: The person who originally owned the assets (like your home in Aro Valley) and decided to set up the trust.

- Trustees: The people you appoint to legally own and manage the assets. They can be family, friends, a lawyer, or a service like the Public Trust. They are the legal decision-makers.

- Beneficiaries: The people the trust is set up to benefit, usually children or grandchildren.

Can a Trust Own Property in New Zealand?

Absolutely. It’s one of the main reasons people set them up.

- The property title is transferred from the individual’s name to the names of the trustees.

- This means the property in suburbs like Wadestown or Khandallah is no longer legally owned by the individual but by the trust itself.

- This structure is central to how trusts protect assets. For a deeper dive, you can explore different property title types in New Zealand.

Selling Property Held in a Family Trust

This is where the process differs from a personal sale. The power to sell rests entirely with the trustees.

- The trustees must formally agree to sell. This is documented in a signed ‘trustee resolution’.

- All trustees must sign the agency agreement with me and the final Sale and Purchase Agreement with the buyer.

- Their decisions must always follow the rules in the Trust Deed and be in the best interests of the beneficiaries.

Trustee Responsibilities & Legal Requirements

Being a trustee is a serious legal role, especially under the Trusts Act 2019.

- Mandatory Duties: You must know the Trust Deed, act honestly, and always act for the benefit of the beneficiaries.

- Best Financial Interests: When selling a property in Wilton or Brooklyn, trustees have a legal duty to get the best possible price the market will pay at the time of sale.

- Wellington-Specific Factors: Trustees must also consider local issues, like earthquake-prone building policies for a Te Aro apartment or land insurance considerations for a home in Houghton Bay. These can impact value.

Common Mistakes to Avoid

Navigating a trust sale can be tricky. Here are some pitfalls I help my clients avoid:

- Assuming One Trustee Can Act Alone: Unless the deed says otherwise, all trustees must agree on and sign everything.

- Not Getting a Professional Appraisal: Failing to get an up-to-date market valuation can be seen as a breach of duty.

- Ignoring the Trust Deed: The deed is the rulebook. Ignoring it can invalidate the sale.

- Poor Record-Keeping: All decisions, meetings, and resolutions must be documented.

Tax & Reporting Obligations (IRD rules)

The IRD has tightened the rules for trusts significantly.

- 39% Trustee Tax Rate: Income retained by the trust is taxed at a flat rate of 39%.

- Stricter Disclosure: Trusts must now provide formal financial statements and detailed information about settlors and beneficiaries in their annual tax returns.

- Bright-Line Rule: The bright-line property rule applies to trusts just as it does to individuals. Any profit from selling a residential property within the bright-line period could be taxed.

Benefits of Using a Trust for Property

Despite the admin, trusts offer powerful advantages.

- Asset Protection: A trust can shield your family home in Ngaio from business creditors or future relationship property claims.

- Estate Planning: It provides a clear structure for passing wealth to the next generation, protecting it from being squandered.

- Continuity: A trust ensures your assets are managed according to your wishes, even if you are no longer able to manage them yourself.

Thinking of Selling? Here’s What to Do Next

If you’re a trustee and considering selling a property in the Wellington City area, the process is manageable with the right team.

- Trustee Resolution: The first step is for all trustees to formally meet and pass a resolution to sell the property.

- Assemble Your Team: You’ll need your lawyer, your accountant, and a local real estate expert. This is where I come in.

- Get a Free Home Appraisal: To fulfil your duties, you need a clear, evidence-based understanding of the property’s value. I provide this as a complimentary service. My network of contacts can also help with any pre-sale needs, like cleaning, gardening, or painting.

Conclusion

Selling property held in a Family Trust doesn’t have to be complicated. With my 30+ years of success selling homes across Wellington City—from Highbury to Hataitai—I understand the nuances and can provide the professional advice you need to ensure a smooth, compliant, and highly successful sale.

Reassuringly, with the right guidance, the process is very manageable. My goal is to help you meet your legal obligations while achieving the best possible outcome for the beneficiaries. If you’re thinking of selling or simply want to understand your options, I’d love to have a friendly chat.

This article is for general guidance only. Always seek professional legal advice before making property decisions involving a Family Trust.

Ready to take the next step? Whether you need a free home appraisal for your trust property or simply want some personalised advice on the Wellington market, I am here to help. Contact Halina today to get the expert guidance you need.

.

.

.

.

.

.

.

.

Disclaimer: The real estate content shared on this blog is intended for general informational purposes only and industry observations. The content may reflect personal views or reference third-party sources, but it is not a substitute for tailored professional advice. Real estate decisions often involve legal, financial, and regulatory complexities, and readers should seek independent guidance from qualified specialists such as legal advisors, financial consultants, or compliance professionals before acting on any information presented here. No warranty is given as to the accuracy, completeness, or current relevance of the material.