Retirement is one of those big life milestones, isn’t it? It’s a chance to take a breath, look around, and really design your next chapter. For so many Wellington homeowners I meet, this exciting new journey often starts with a single question: what potential is locked away in the family home?

Quick note before we jump in: The information here is just for general interest, it’s not official advice. Some of it’s based on opinion or pulled from property news sources that share useful tips, we do our best but we can’t guarantee it’s all spot-on or fully complete.

Planning for retirement is something to look forward to, an exciting time to plan together for a new lifestyle filled with freedom and adventure. Whether it’s that spacious classic in Karori or a charming hillside spot in Ngaio, your property is likely your biggest asset. It holds the key to a future you’ve been dreaming of.

Planning Your Next Chapter in Wellington

The idea of retirement usually kicks off conversations about lifestyle changes, travel plans, and what genuine financial freedom looks like. It’s a time for you and your partner to dream together, making plans that truly align with your passions and goals.

This period isn’t about ending a career; it’s about starting a brand-new adventure, one filled with all the things you love doing.

From Dreams to a Concrete Plan

Thinking about selling the family home can feel massive, but it doesn’t have to be overwhelming. This is exactly where having a local, experienced professional in your corner makes all the difference. As a Wellington real estate expert, I specialise in helping homeowners navigate this precise transition with confidence. I know the unique market dynamics of suburbs like Wilton, Island Bay, and Brooklyn inside and out.

A great first step is to know where you stand. A complimentary, no-obligation appraisal from me provides the clarity you need to turn those abstract dreams into a solid plan. It provides a clear and accurate estimate of your home’s current market value, which is the cornerstone of any effective retirement strategy.

Creating Your Support Network

Selling a property involves more than just a listing; it requires a whole team of trusted professionals. Over the years, I’ve built a strong and trusted network of contacts who can help with every part of the process.

Whether you need a hand with home clearing, packing, cleaning, painting, or require sharp legal and financial advice from an accountant or solicitor, I can connect you with reliable experts for your consideration who can help make the entire transition feel simple and effortless.

This is your chance to build a future that truly excites you. Imagine having more time to explore all the wonderful things to do in Wellington, travelling, or simply dedicating more hours to your favourite hobbies. The whole journey starts with a simple conversation.

Explore all the retirement options available for New Zealanders and create a strategy that works for your unique situation. Taking that first step can set you firmly on the path to a fulfilling and vibrant retirement. Make the first move today!

The Lifestyle Benefits of Downsizing Your Home

Picture this: a life with less time spent on home maintenance and more freedom to actually enjoy it. For many Wellingtonians, the decision to move on from a larger family home isn’t just about unlocking capital, it’s about stepping into a brand-new lifestyle, full of exciting possibilities. It’s a chance to finally swap weekend chores for weekend adventures.

Selling a larger property in suburbs like Wadestown, Karori, or Khandallah is a significant financial move, but the real win is often measured in time and peace of mind. Downsizing means reducing expenditures on things like rates, maintenance, and running costs. It frees you from those obligations, giving you more time for travel and hobbies.

Reclaiming Your Time and Energy

A smaller, more manageable home means you spend less time working on your property and more time enjoying your life. All those hours you used to spend on maintenance can now be poured into hobbies you’ve always wanted to try, travelling our beautiful country, or simply having more precious moments with family and friends.

This shift frees up your finances, too. Lower running costs, smaller insurance premiums, and reduced rates bills mean more disposable income for the things that truly matter to you. This financial breathing room is a cornerstone of a comfortable, stress-free retirement.

Downsizing isn’t about giving things up; it’s about gaining a lifestyle rich with freedom, flexibility, and the opportunity to focus on what brings you joy.

Making the Transition Smooth and Simple

The thought of moving can feel overwhelming, but it doesn’t have to be. As a local Wellington real estate professional, I get the emotional and practical sides of this journey. My role is to make the whole process feel seamless and exciting, not stressful.

To help with this, I’ve built a network of professionals who, if required, can help you handle every little detail. Whether you need a hand with packing and clearing, a painter to freshen things up, or a gardener for a final tidy-up, my contacts are here to help you. This support system ensures your transition is handled with care, so you can focus on the exciting chapter ahead. For more insights, you can explore the many upsides to downsizing your home in our detailed guide.

Exploring Your New Lifestyle Options

New Zealand offers a wonderful variety of cities and towns perfect for retirement living. From the sunny coastlines of the Bay of Plenty and Tauranga to the relaxed pace of Nelson or the vibrant communities in Queenstown and Wanaka, there are countless places you could call your next home. Many retirees are also looking at modern retirement villages, which offer vibrant communities, excellent facilities, and a range of living options.

A great way to start is by getting in touch with a retirement village operator. Their friendly customer service teams are always happy to explain what they offer and arrange a tour so you can experience the lifestyle firsthand.

The very first step in this exciting journey is understanding what your current home is worth. Reach out to me, Halina, for a complimentary appraisal to get a clear picture of where you stand financially. Let’s start the conversation today and plan your move toward a more liberated and fulfilling retirement.

Exploring Retirement Village Lifestyles

For a lot of Kiwis thinking about their next move, a retirement village looks like a fantastic mix of independence, community, and peace of mind. Forget the old stereotypes; today’s senior living complexes and villages are more like vibrant, resort-style communities built for people who want to live active, engaged lives. It’s all about upgrading your lifestyle, not winding it down.

Picture waking up somewhere beautiful, where the grounds are perfectly kept and the facilities are second to none. These communities are designed around social connection and making life easier, which can feel incredibly liberating after years spent maintaining a large family home.

A Community-Focused Way of Life

One of the biggest attractions of village life is the ready-made community. Loneliness can creep in during our later years, but retirement villages are specifically designed to bring people together. They usually have a packed social calendar with all sorts of activities, clubs, and events, so it’s easy to meet people with similar interests and forge new friendships.

Many villages offer a fantastic range of amenities right on the doorstep, such as:

- On-site cafes and restaurants for a coffee or a meal with friends.

- Swimming pools, gyms, and wellness centres to help you stay active and healthy.

- Bowling greens, libraries, and workshops for all your hobbies and interests.

- Organised outings and events, from movie nights to day trips.

This kind of setup means you can be as social or as private as you like, with plenty of opportunities to get involved just a short stroll from your front door. It’s a brilliant way to have a rich social life without having to go far at all.

Understanding the Living and Financial Models

Retirement villages here in New Zealand provide a variety of living options to suit different needs. You could go for an independent villa with your own garden, a modern apartment with great views, or even a serviced apartment that offers a bit of help with things like meals and cleaning. This flexibility means you can find a home that perfectly suits the level of independence you want.

Financially, most villages work on a ‘license to occupy’ (LTO) model. Now, this is quite different from standard home ownership. You’re buying the right to live in your unit for your lifetime, but you don’t actually own the title to the property. It’s a very common and well-established model, but it’s crucial you get your head around how it works.

When it’s time to leave the village, the operator resells the unit. You (or your estate) then get your initial investment back, minus what’s called a deferred management fee. This fee is what covers the development and ongoing upkeep of all the wonderful community facilities you get to enjoy.

Your Professional Team is Key

Moving into a retirement village is a huge decision, and getting expert advice is non-negotiable. Before you sign anything, it’s absolutely vital to have your solicitor review the agreement. They’ll walk you through the fine print, making sure you fully understand how the agreement works, your rights, and your obligations. An accountant can also be invaluable, helping you see how the financial side of things fits into your wider retirement plan.

The best way to start exploring this option is simply to go and have a look. I always suggest calling a few different village operators to arrange a tour. Their teams are always friendly and more than happy to show you around, answer all your questions, and give you a proper feel for the community.

If this sounds like an appealing path for your retirement, a critical first step is figuring out what your current home is worth. A complimentary appraisal of your Wellington property will give you the financial clarity you need to explore all your options with confidence. As a local real estate professional, I can provide this for you and also connect you with my network of professionals, from cleaners and painters to legal experts, who can make your move as smooth as possible. Let’s have a chat and start planning your next exciting chapter today.

Building Your Financial Foundation for Retirement

A comfortable retirement doesn’t just happen by accident. It’s built on a clear understanding of your financial assets, and for most Kiwis, this rests on a few key pillars. Getting a sharp picture of your finances is the very first step toward creating the next chapter you’ve been looking forward to.

The journey starts with a realistic look at your income streams. For many of us, that means a combination of government support and our own personal savings working together to create a reliable financial base.

Understanding Your Income Sources

New Zealand Superannuation (NZ Super) is a cornerstone for retirees in our country. It’s a stable pension for eligible residents aged 65 and over, providing a dependable foundation for day-to-day living costs.

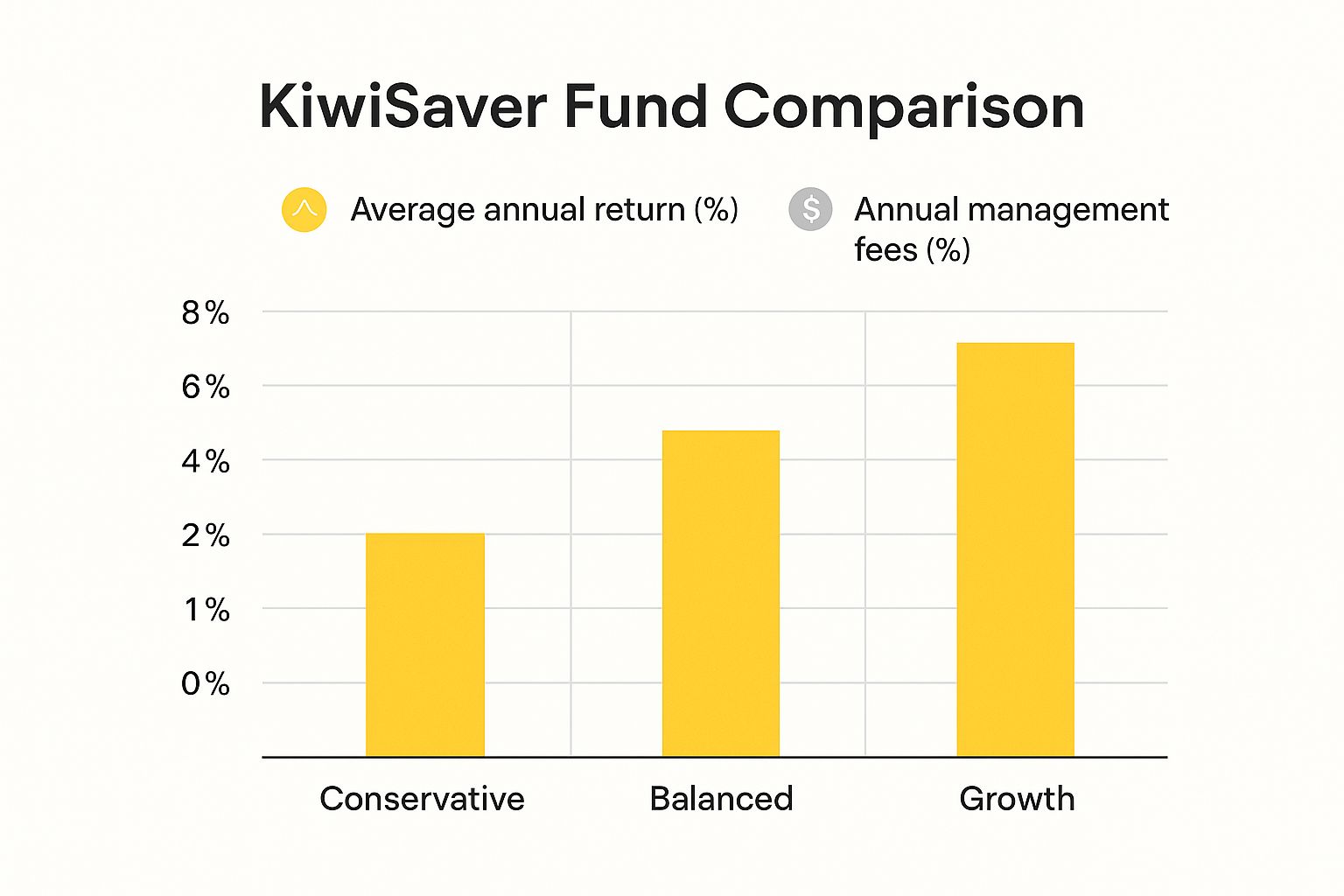

Of course, alongside NZ Super is your KiwiSaver fund. This is the personal savings account you’ve built up throughout your working life, with contributions from you and your employer. It’s designed to give you a significant lump sum or a regular income to really top up your other funds. These two working in tandem are a powerful combination for a solid retirement income.

Your Property as a Primary Asset

For so many Wellington homeowners, the most significant asset they hold is their family home. The equity you’ve patiently built up over the years represents a huge financial resource that can be unlocked to fund the retirement you’ve been dreaming of.

Whether you own a classic villa in Thorndon, a family home in Karori, or a chic apartment in Te Aro, its value is a critical piece of your financial puzzle.

Knowing what your property is actually worth in the current market is essential. This is where a professional appraisal becomes so important. As your local Wellington real estate specialist, I, Halina, can provide a complimentary, no-obligation appraisal to give you a clear, realistic estimate. This knowledge is what empowers you to make sharp, informed decisions about what’s next. You might also find our guide on the costs associated with Wellington apartments useful for understanding different property types.

Knowing the true value of your home isn’t just a number—it’s the key that unlocks your ability to plan with certainty and pursue the retirement lifestyle you’ve always wanted.

Assembling Your Professional Team

Navigating the financial and legal side of retirement planning is a big deal, and it pays to have expert guidance. Selling a property and moving into retirement is far more than just a real estate transaction; it requires a coordinated effort from a team of trusted professionals.

I firmly believe in providing a complete support system for my clients. Through my extensive professional network, I can connect you with highly regarded solicitors and accountants right here in Wellington for your consideration.

- A solicitor will review property contracts, explain the legal jargon in a “license to occupy” agreement for a retirement village, and make sure your interests are protected every step of the way.

- An accountant or financial advisor can help you structure your finances to be as tax-efficient as possible and map out a long-term plan that actually matches your retirement goals.

This team approach ensures every part of your plan is solid, secure, and perfectly suited to you. If you’re ready to take that first step, let’s have a chat. Contact me today to discuss your goals and arrange a free appraisal for your home.

Ten Inspiring Benefits of a Well-Planned Retirement

Planning for retirement is about so much more than just crunching the numbers. It’s about genuinely designing a future you’ll love one filled with joy, freedom, and new adventures. When you start to actually visualise what that life could look like, the motivation to take that first step becomes crystal clear.

A well-planned retirement isn’t an endpoint; it’s the beginning of a vibrant new chapter, supported by a strong national savings framework like the New Zealand Superannuation Fund.

Here are ten inspiring benefits that are waiting for you with a well-thought-out retirement plan.

1. Freedom to Travel and Explore

Imagine finally having the time to take that long-awaited road trip across the South Island or discover the hidden gems of the North. Retirement gives you the ultimate freedom to travel on your own schedule.

2. More Time for Hobbies and Passions

Whether it’s getting stuck into the garden, painting, fishing, or joining a local club in Wellington, you’ll finally have the time to dive deep into the things that bring you the most happiness.

3. Reduced Stress and Less Maintenance

Downsizing from a large family home in Karori or Wadestown means saying goodbye to weekend-long chores and endless upkeep. A smaller, more modern home gives you more time to relax and far less to worry about.

4. Stronger Social Connections

With more free time on your hands, you can invest in what really matters: your relationships with family and friends. It’s a wonderful opportunity to create lasting memories with grandchildren or reconnect with old friends.

5. Improved Health and Well-being

Less stress and more time for activities you love can have a massive positive impact on both your physical and mental health. You can finally focus on staying active, eating well, and enjoying a more relaxed pace of life.

6. The Chance to Learn Something New

Have you always wanted to learn a new language or pick up a musical instrument? Retirement is the perfect time to challenge yourself and pursue new knowledge without any pressure.

7. Greater Financial Security

A solid retirement plan brings incredible peace of mind. Knowing your finances are sorted allows you to enjoy life without constantly worrying about your budget, giving you true financial freedom.

8. Flexibility and Spontaneity

Feel like a spontaneous trip to the coast on a sunny Tuesday? Now you can! Retirement offers the gift of a flexible schedule, letting you live life entirely on your own terms.

9. Opportunities to Give Back

Many retirees find immense satisfaction in volunteering for causes they care about. It’s a brilliant way to stay engaged with your community and make a meaningful difference.

10. A Deeper Sense of Purpose

Retirement allows you to reflect on your life and focus on what truly matters to you. It’s a chance to live with real intention and create a legacy that reflects your values.

These benefits are well within your reach. The first step is simply understanding where you stand right now. A complimentary home appraisal can give you the clarity you need to start planning.

Contact me, Halina, today to discover what your next chapter could look like.

Take the First Step Toward Your Dream Retirement

That journey to an incredible retirement? It doesn’t have to be overwhelming. More often than not, it all kicks off with one simple thing: a friendly conversation. We’ve explored the different options for Kiwis, from downsizing the family home to embracing the buzz of a retirement village. Now, it’s about moving forward with a bit of confidence.

The very first step is often the easiest, and it really does all start with a confidential chat.

Your Personalised Retirement Plan Starts Here

Every homeowner’s situation is completely different. Maybe you’re in a big family home in Vogeltown and are just curious about what it’s worth these days. Or perhaps you live in Te Aro and are simply playing with the idea of what downsizing could look like for you. Whatever your circumstances, understanding your options is the key.

A Network of Support at Your Fingertips

Getting a home ready for the market and organising a move can feel like a massive job, but you really don’t have to go it alone. Over the years, I’ve built up a trusted network of professionals who can help with pretty much anything you might need.

- Home Preparation: I have great connections with reliable cleaners, gardeners, painters, and home-clearing services to get your property looking its best.

- Professional Advice: I can also put you in touch with respected solicitors, accountants, and financial advisors to make sure all your legal and financial ducks are in a row.

This team approach is all about making your transition as smooth and stress-free as possible, so you can focus on the exciting chapter ahead.

Taking that first step is the most powerful move you can make toward the retirement you’ve always pictured. It’s about turning dreams into a real, achievable plan.

There’s no reason to wait to start planning. The best time to begin exploring your retirement options is right now. Reach out to me, Halina, for a friendly, no-obligation chat about what you’re hoping for. Let’s start the conversation and map out your path to a wonderful retirement.

Contact Halina today to book your free, no-obligation home appraisal.

Your Questions Answered: Retiring in Wellington

Moving into retirement is a big step, and it’s natural to have plenty of questions. To help you feel more confident, I’ve answered a few of the most common queries I hear from Wellington homeowners who are starting to plan what’s next.

What’s the Best Time of Year to Sell My Family Home in Wellington?

While Wellington’s property market is pretty active all year round, a lot of sellers have great success in spring and autumn. It makes sense—the weather is usually a bit better, gardens are looking their best, and more buyers are on the hunt before the summer holidays or winter slowdown kick in.

But don’t write off winter. Selling when it’s colder can actually work in your favour. With fewer properties on the market, your home in a suburb like Karori or Khandallah will have less competition, catching the eye of serious buyers who are ready to move. The truth is, the “best” time really comes down to your own situation and what the market is doing right now. A quick chat with a local expert like myself can help you map out a strategy that fits your plans perfectly.

How Do I Figure Out My Home’s Value for Retirement Planning?

Knowing what your home is worth is the absolute foundation of good retirement planning. Online valuation tools can give you a ballpark figure, but they just can’t see the unique character of your property or understand the vibe of your local neighbourhood, whether that’s the quiet streets of Wilton or the bustling community in Newtown.

The only way to get a truly accurate figure is with a professional market appraisal. I provide a complimentary, no-obligation appraisal that looks at recent sales in your area, what buyers are looking for, and all the specific features that make your house a home. This gives you a solid, realistic number to work with, so you can make those big decisions with confidence.

Should I Renovate My House Before I Sell It to Downsize?

This is a question I get all the time, and the answer is nearly always, “It depends.” Big, expensive renovations rarely give you a dollar-for-dollar return on what you spend. In my experience, focusing on smaller, high-impact improvements is a much smarter move.

Things like a fresh coat of paint, a good declutter, a professional clean, and tidying up the garden can make an enormous difference without breaking the bank. I’ve built up a great network of trusted local tradespeople—from painters to gardeners—who can help get your home ready for the market quickly and efficiently. Before you start knocking down walls, it’s always worth getting some expert advice to make sure your efforts will actually add value and attract the right buyers.

Ready to start exploring your retirement options? For personalised advice and a clear picture of your property’s value, get in touch with Halina Kuchciak of Ray White Wellington.

.

.

.

.

.

.

.

.

.

.

.

.

.

Disclaimer: The real estate content shared on this blog is intended for general informational purposes only and industry observations. The content may reflect personal views or reference third-party sources, but it is not a substitute for tailored professional advice. Real estate decisions often involve legal, financial, and regulatory complexities, and readers should seek independent guidance from qualified specialists such as legal advisors, financial consultants, or compliance professionals before acting on any information presented here. No warranty is given as to the accuracy, completeness, or current relevance of the material.